Articles by Oakleigh Wealth

The Backdoor Roth IRA

Roth IRA accounts are one of the most tax efficient retirement savings vehicles. But if your income is over the phase-out limits, you will not be able to contribute directly to your Roth IRA. Enter the so-called “backdoor Roth,” a loophole which allows you to add to your Roth IRA when your income is otherwise over the limit. BUT… it doesn’t come without risk.

Flow-Based Budgeting

Have you ever tried to make a budget, but never really bought into it? Maybe it went out the window when life happened. Perhaps you felt like the bad cop when trying to make sense of your credit card bill with your spouse. Or, were you were the one being interrogated?!

Budgeting is challenging. It can generate conflicts and induce guilt or shame. It can feel artificially constraining and time-consuming.

I’ve tried many budgeting systems, and I’ve quit them all. That is, until I learned about Flow-Based Budgeting.

The Case for Long Term Disability Insurance

Welcome to the world of adulting, where every decision seems to have a weighty financial consequence, but the outcomes are never certain. Amidst the financial maze, disability insurance is one of those topics that can be easily brushed off as something you'll think about later. However, in reality, it's a crucial aspect of your financial stability.

Disability insurance provides income replacement if you become unable to work due to illness or injury. Like life insurance, it also protects your family against financial hardship from the loss of your stream of income. Yet, like many types of insurance, you hope you'll never need to use it. So, how can you determine if it's a worthwhile investment for you?

Key Issues When Evaluating Disability Insurance Policies

Disability insurance is critical to protecting your income should you suffer an illness or injury that prevents them from continuing to work.

To help you guide you through the complexities of this important topic, we created this checklist. It covers key considerations, including:

Key policy features and definitions

Group and individual coverage options

Federal benefits

Tax implications

Risk Tolerance & Risk Capacity

Determining the right investment strategy is crucial for achieving long-term financial goals. Two key factors that play a pivotal role in shaping an individual's investment approach are risk tolerance and risk capacity. While these terms are often used interchangeably, they carry distinct meanings, each influencing how investors should approach investment selection.

Merging Financial Accounts In Marriage

The Atlantic recently published an article on the often-asked, titular question: “Should Couples Merge Their Finances?” Rather than give a direct answer, author Joe Pinsker presents a nuanced overview of the plusses and minuses of the three basic approaches: joint, separate, and hybrid. Crucially, he also points to the deeper truth that “the notion that you can keep your finances truly ‘separate’ is to some degree an illusion. Navigating the financial tensions and answering this question in the context of your marriage requires more than statistics about marital satisfaction or awareness of underlying gender equity issues.

10 Free & Effective Ways to Protect Yourself from Identity Theft

The threat of identity theft looms larger than ever before. Cybercriminals are constantly finding new ways to steal personal information and wreak havoc on your financial well-being. Protecting yourself from identity theft is an essential piece of a comprehensive financial plan. Here are ten inexpensive and effective things you should be doing to safeguard your identity:

Can I make a “Mega Backdoor Roth” Contribution?

Say you have maxed out your pre-tax IRA and 401(k) contributions (or Roth IRA and Roth 401(k), if current tax rates are lower) and you still have the ability to save more, you don't need liquidity and want to do it as tax efficiently as possible.

In certain cases, you may be eligible to make a Mega Backdoor Roth contribution and contribute tens of thousands more to your Roth IRA, regardless of your income level.

Q: How much liability insurance do I need? A: As much as you can get!

Cut to the chase: with liability insurance, you should carry as much as you can. Most individuals and families carry liability insurance from two main sources: their home and auto insurance policies. But this may not be enough to fully protect your assets in case of an accident or a lawsuit.

That’s where “umbrella” insurance comes in, to cover you above the liability limits of your home and auto policies. However, you must coordinate coverage with your home and auto policies to make sure that you don’t have a potentially expensive gap in coverage.

You need a will, but do you need a lawyer?

Estate planning can be an uncomfortable subject. Most of us would prefer not to think about our demise, so we avoid it. Or, you may not know where to start, and the added hurdle of finding a lawyer has led you to put off creating or updating your will. But, like most people, you probably don’t need a layer to make a will.

How much life insurance do I need?

If there is someone in your life who depends upon your current and future income for financial support, then you probably need life insurance to transfer the financial risk of an untimely death. The proceeds of a life insurance policy can cover your family’s immediate financial needs in the wake of your death, replace lost income, repay debt, and provide for your family’s expenses and goals. But how do I know how much and what type of insurance to buy?

Equity Compensation: opportunities, risks, biases, and taxes

Long the domain of only the C-suite and key employees, equity compensation is increasingly used to motivate and retain younger and mid-level employees of the leanest startups to the largest public and private enterprises.

But, while these programs offer the potential for significant wealth accumulation, they also increase the level of risk the employee and her family are exposed to should the company take a turn for the worse. Armed with the knowledge of how these programs work and how they fit within your overall financial plan, you can take advantage of them from a position of clarity and security.

Stock Options: ISOs and NSOs

Stock options give the recipient the right, but not the obligation, to purchase shares of company stock at a predetermined price for a certain period. If the price of the company stock increases, the option holder will be able to purchase shares at a lower price than the current market price once the options vest (or the plan may allow for early exercise). Stock options have a lot of financial leverage, meaning if the stock goes up a lot you can receive a huge amount of value.

Employee Stock Purchase Plans

Employee Stock Purchase Plans give participants the chance to buy company stock at a discount of up to 15% and are funded with regular paycheck withholdings. At the end of the offering period, you can sell the shares and lock in a nearly “risk-free” profit that will be taxed just like a cash bonus, or if you hold the shares, you may become eligible for more favorable capital gains treatment for a portion of the gain (assuming there are gains!)

Restricted Stock Units (RSUs)

RSUs are one of the simplest and most common forms of equity compensation. They are essentially a promise of a given quantity of stock at a future date. Once the shares are vested and taxes are accounted for, you own the company stock just as if you had purchased it on your own. The key question to ask yourself when deciding whether to hold the shares or sell them immediately is this: “If I got a cash bonus instead, would I use it to buy shares in my company?” If not, that’s a good indication that you should just cash out now, or as the Steve Miller Band put it, “Go ahead, take the money and run!”

June 2023 Newsletter: Tax Planning

This month's newsletter is all about taxes!

You're already ahead of the pack if you’ve kept reading beyond the first line. So many individuals try to limit the time and brain space devoted to taxes to the scramble of weeks leading up to Tax Day. The saying about “death and taxes” notwithstanding, there actually is something to be done when it comes to managing the impact and timing of your tax liability over the long run. Still, the time to do something about it is not the first two weeks of April when the bill comes due.

Defining the Elements

At Oakleigh, we use an app called Elements to show a quick snapshot of your financial health and track specific key metrics over time. This is very similar to how a doctor might track your vital signs to understand your physical health and quickly diagnose specific issues. Of course, there’s a story behind all of these numbers and we would dive much deeper for a full financial planning engagement. However, you might be surprised by how many important issues can be uncovered and addressed from these high-level metrics alone.

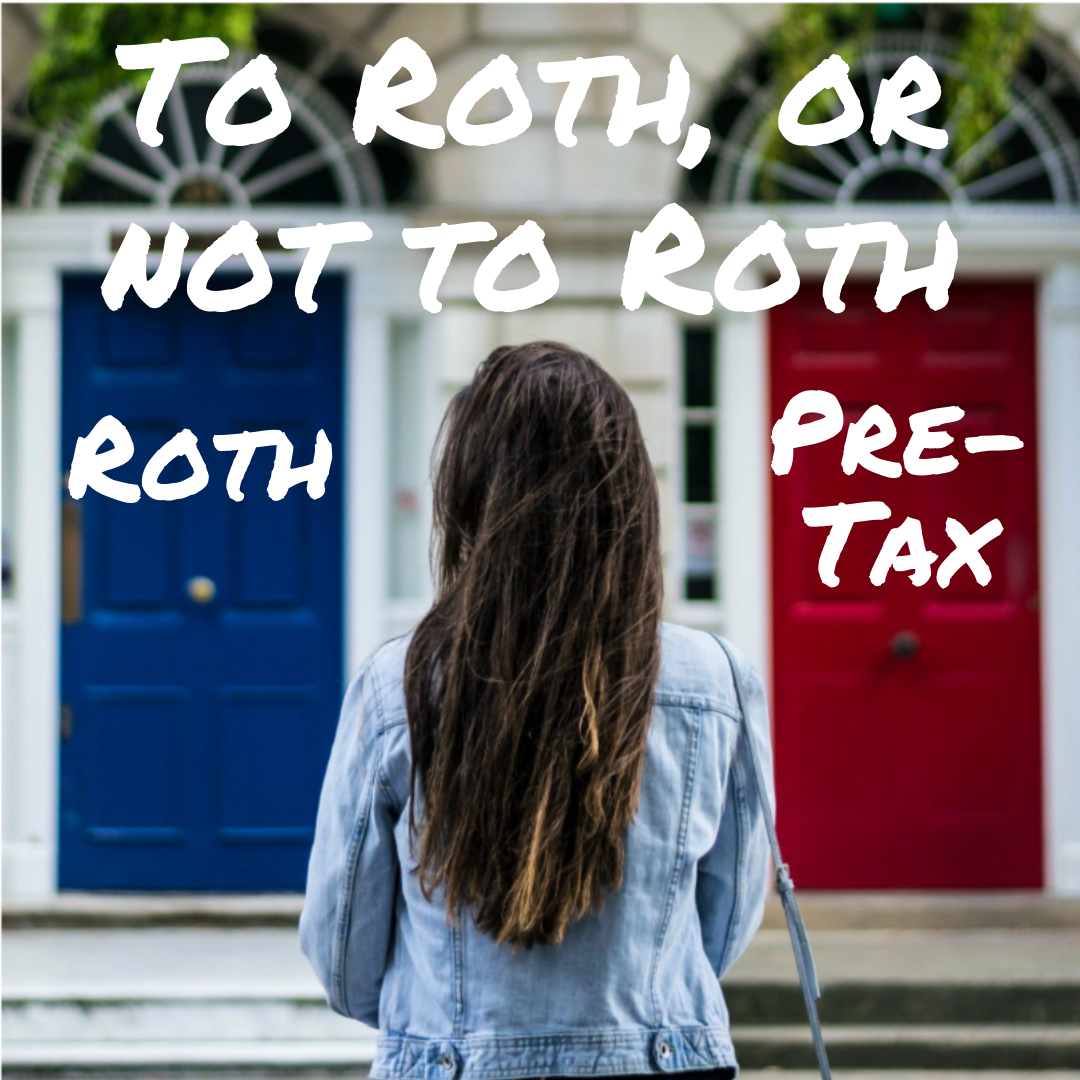

To Roth or Not to Roth? Deciding Between Roth and Tax-Deferred Savings

The decision of whether to contribute to a Roth or a traditional retirement account basically boils down to timing: do I pay taxes now or later? While both types of retirement accounts are powerful tools for building wealth, this seemingly simple binary can produce some unique planning opportunities with meaningful tax savings for many individuals.