Articles by Oakleigh Wealth

Investing Success

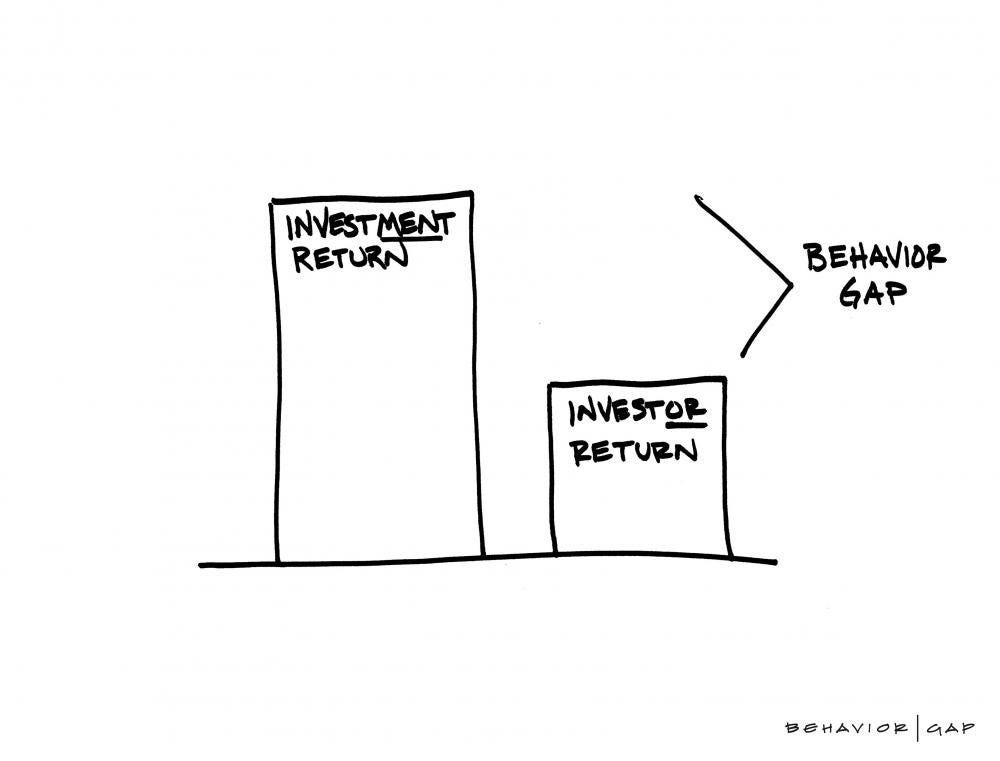

Investing success is more a function of behavior than skill or technical ability. The context in which we’ve grown up, our past experiences, and the biases we carry shape how we measure success and profoundly influence our perception of risk.

This post focuses on what I think are the two most fundamental topics in all of investing:

The Risk/Return Tradeoff

The Behavior Gap

Making the most of your money

My friend Taylor and I were talking recently about why folks seek out financial advice, and he summed it up like this: "They want to feel like they are making the most of their money."

At first blush, it sounds like our job is to help people make more money, but that's not what he meant. Everyone wants to know that they're making good decisions with their money, that they're not missing out, that they’re not exposing themselves and their families to undue risk, and that they're not being taken advantage of.

How to find your financial purpose

Have you ever watched a new sport? One of the first things to understand is “How do you win?” meaning, what is the ultimate goal? Is it the highest score (e.g., football)? Lowest score (e.g., golf)? How do you score in the first place?

We rarely ask that about life itself. We live and then later look back, wondering what the hell we’ve been doing all these years. Read on to learn how to start asking— and answering— that question about life itself.

The 6 variables you can actually control

Personal finance can be overwhelming. Here’s the good news. There are only six variables you can actually control. Everything else is out of your hands. Do what you can with those six variables to give yourself the best chance of pursuing your financial purpose, and from there, life will be what it will be.

Personal finance is simple, but hard

Personal finance is pretty simple. If you save 20% of your income, have proper liquidity, carry basic insurance (home, auto, liability, life, disability), and invest your long-term money in a low-cost diversified index fund (and don’t sell), you’ll probably be just fine.

While it may be that simple, it’s also hard.

Why we wrestle with the shift from saving to spending

There are a couple of reasons why retirees might find it hard to switch from saving to spending:

Fear of running out:

Habit and mindset:

Loss of regular paycheck:

These anxieties are common, and there are strategies to contextualize and address them to develop a healthy spending plan in retirement. However, they also point to a universal human struggle that‘s observable from a young age: the difficulty balancing between present and future enjoyment.

Retirement: Math Problem vs. Human Problem

I came across this fantastic illustration by British retirement podcaster and financial planner Dan Haylett a couple of weeks ago. It perfectly captures a dynamic I’ve written about on this blog more than a few times. Namely, the misperception we all have that financial planning is a math problem; an equation to be solved having either a right ora wrong answer.

How much is enough? A parable from Jimmy John’s

My best friend, a Jimmy John’s sandwich shop regular, alerted me to a story that hangs on the wall in the restaurant, entitled “How much is enough.”

This story hit home, but not because it’s a prescient critique of certain American attitudes about money (though it is that ). Rather, as I struggle to launch a business while juggling all of the demands of family life with young children, I realized how easily I fall into the same trap as the “poor” fool in this parable.

This simple vignette illustrates the folly of the arrival fallacy (I’ll have enough when…) and the universal difficulty we often have distinguishing between wants and needs, while also recognizing the value of what we already have.

Enjoy, then go grab a sandwich!

Risk Tolerance & Risk Capacity

Determining the right investment strategy is crucial for achieving long-term financial goals. Two key factors that play a pivotal role in shaping an individual's investment approach are risk tolerance and risk capacity. While these terms are often used interchangeably, they carry distinct meanings, each influencing how investors should approach investment selection.

Merging Financial Accounts In Marriage

The Atlantic recently published an article on the often-asked, titular question: “Should Couples Merge Their Finances?” Rather than give a direct answer, author Joe Pinsker presents a nuanced overview of the plusses and minuses of the three basic approaches: joint, separate, and hybrid. Crucially, he also points to the deeper truth that “the notion that you can keep your finances truly ‘separate’ is to some degree an illusion. Navigating the financial tensions and answering this question in the context of your marriage requires more than statistics about marital satisfaction or awareness of underlying gender equity issues.

Open Palm vs. Closed Fist

In the delicate act of holding a feather, we are presented with a profound metaphor for life itself. We can clasp it tightly within a closed fist or cradle it gently in the open palm of our hand. Each approach reflects a unique philosophy.

The closed fist represents our instinct to cling to what we cherish, to shield it from the unpredictable wind of change. It's an act of guarding, protecting, and controlling. We often do this out of fear or the desire for certainty and assurance. But, as we clench our fists, we inadvertently obscure the very beauty of what we hold. And what’s more, life rarely conforms to our demands for control.

Two Logics

We live in a culture that has become wildly imbalanced, like a bodybuilder who has pumped his right side up to excessive proportion while allowing his left side to shrivel away

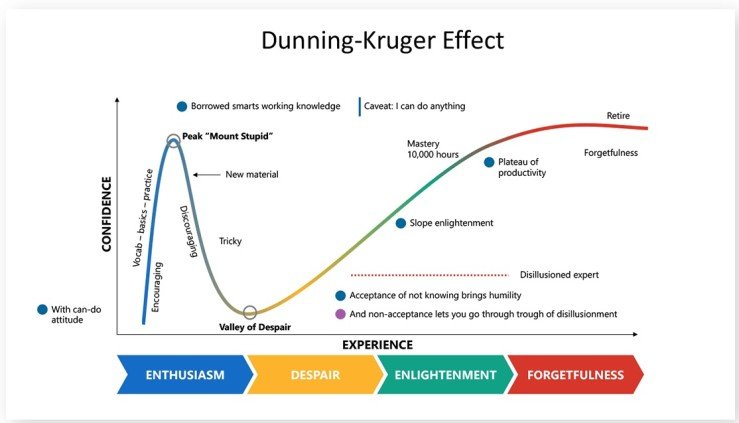

The Dunning-Kruger Effect (in investing (and life)

Dunning & Kruger’s study demonstrated something we all know to be true from experience: people with low levels of knowledge, skill, or competence tend to overestimate their own abilities. Their findings have broad implications for personal finance and investing, but it also raises broader questions about the human experience more generally. We are all prone to over confidence. Mastery, in any arena of life, requires that we overcome the despair of failure through dilligence and humility. But is that all there is?

Invest or pay off debt?

No one likes the feeling of being indebted, whether it’s actual debt (student loans, mortgages, credit card…), or more generally in the sense of feeling an obligation to return some favor. And as this opening observation demonstrates, the decision of whether to pay down debt is often as much one of emotion as it is cold financial math. Therefore, answering the question of whether I should pay down my mortgage early or try to invest the savings in the market requires looking at both the math and the emotion of debt.