Investing Success

Investing success is more a function of behavior than skill or technical ability. The context in which we’ve grown up, our past experiences, and the biases we carry shape how we measure success and profoundly influence our perception of risk.

This post focuses on what I think are the two most fundamental topics in all of investing:

The Risk/Return Tradeoff

The Behavior Gap

The Risk vs. Return Tradeoff

The fundamental relationship that applies to all investing is the tradeoff between risk and return. Generally, the higher the risk you take, the higher the potential returns you should require—but also the greater potential for loss. The challenge is managing that risk to achieve your desired returns without overextending yourself.

It’s important to avoid measuring investment success solely by returns. Instead, judge your decisions by the quality of information and processes used at the time, not the outcome. Just because an investment yielded a high return doesn’t mean it was a good decision. The outcome says nothing about what was placed at risk to achieve it, the probability of success, and whether the strategy is repeatable or just luck.

Conversely, failure doesn’t necessarily mean you made a poor decision. Investing is not about being right every time. In fact, with proper diversification, you only need to be right about half the time to succeed. Even then, a few decisions within a few short periods account for the vast majority of performance.

Good investors spend most of their time and energy understanding and managing risk, not chasing returns or getting caught up in market speculation.

So What Can You Do?

Understand Your Risk Capacity: Don’t risk what you can’t afford to lose. Know how much downside risk you’re comfortable with. Be sure that your portfolio is aligned with your actual goals.

Diversification: Spread your investments to minimize the impact of any single investment going wrong. Watch out for high concentrations or risk in particular investments or sectors (especially things like company stock or individual real estate holdings)

Get the Big Stuff Right: The most significant driver of your portfolio’s overall returns is not the risk/return characteristics of each position but how they behave as a whole. What matters most over time is things like what percentage you have in stocks vs. bonds, your exposure to international stocks, and the mixture of small vs. large companies.

Long-Term Focus: Successful investing is measured in decades, not weeks or months, or even years. Don’t get distracted by short-term market fluctuations. Stick to your plan and give it time to work.

Keep Fees Low: As Jack Bogle famously said, “In investing, you get what you don’t pay for.” High fees eat into your returns, so keep your costs low by opting for low-fee index funds and other cost-effective investment options.The Behavior Gap

The Behavior Gap

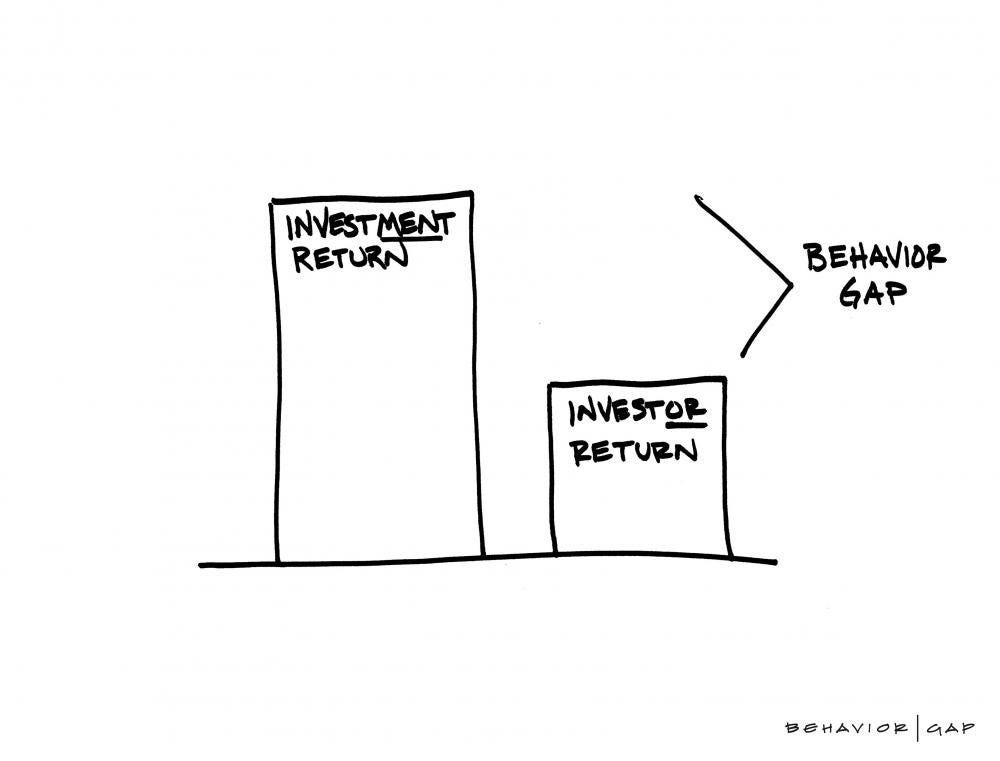

Carl Richards coined the term “behavior gap" to describe the difference between investor and investment returns. Contrary to what you may have assumed in Economics 101, none of us actually behaves rationally all the time. We are far more prone to cognitive biases than we would like to believe, and our decisions are far more driven by emotions.

Psychologist Jonathan Haitd uses the metaphor of the elephant and the rider in his seminal book The Happiness Hypothesis. The human rider atop the elephant represents the rational mind, while the elephant represents the emotional mind. If ever the two disagree, you can bet which one will win the argument.

Our context—where and when we were raised—significantly influences how we view the world and interpret financial decisions. Whether we realize it or not, our upbringing affects the stories we tell ourselves about money, risk, and opportunity. A parent who came of age during a great depression sandwiched between two world wars will have a very different worldview from their child whose formative young-adult years were during the stagflation of the 1970s, which will differ from the millennial who’s investing expectations have been shaped by the incredible US stock market run of the last 15 years.

Beyond these stories, we’re also more prone to biases than we think. Evolutionarily, we are not very good at evaluating low-probability events and seek to avoid losses. After all, it’s far better to assume there’s a lion in the bushes and be wrong than to assume there isn’t.

We seek information that confirms our viewpoint. Hindsight bias leads us to overconfidence. We give more weight to new information over old information. We follow the herd because we fear being left behind. We anchor our decisions on arbitrary data points because we’re overloaded with information. We attribute our successes to skill and failures to bad luck or circumstance, while we attribute others' successes to luck and their failures to ineptitude.

In investing, emotions like fear, envy, and exuberance often drive our financial decisions. This is precisely why the “behavior gap” exists: exuberance and greed lead us to buy high, and fear leads us to sell low. Rinse and repeat.

So What Can You Do About It?

You will never escape these psychological forces, but you can turn them to your advantage and mitigate their impact by:

Awareness: Recognize your own biases and emotions. Be mindful of how fear, greed, or overconfidence might influence your choices.

Purpose: Know why you’re investing. What is your end goal? Whether it's retirement, funding college, or entertainment, clearly defining your purpose leads to better outcomes.

Have a Plan: A clear plan is essential. What are you going to invest in? How long do you plan to hold it? When and why will you sell? Most investors don’t have a plan, which is often why they struggle when faced with market fluctuations and noise.

Tune Out the Noise: Block out the constant chatter from financial news, the office water cooler, and your brother-in-law. Focus on your long-term goals, not the latest hype or fear-inducing headlines, and don’t confuse your goals with someone else’s.

Patience and Simplicity

Here’s a simple exercise: Ask yourself, “Why is my money invested the way that it is?”

If the answer is not something like, “because it gives me the highest chance of reaching my goal with the lowest amount of risk,” then you may have some thinking to do.

Investing doesn’t have to be exciting. In fact, boring is perfectly good! Chasing the hottest fund manager or stock and trying to time the market is exhausting and counterproductive.

A simple, diversified portfolio of low-cost index funds can work wonders over the long term. By figuring out a reasonable investment allocation based on your risk tolerance and goals (and sticking to it), you will set yourself up for long-term success.

And the best part? You can spend more time living your life rather than stressing about daily market movements.