Invest or pay off debt?

Debt almost always feels like a burden, but our attempts to avoid it can actually stunt our goals

No one likes the feeling of being indebted, whether it’s actual debt (student loans, mortgages, credit card…), or more generally, as in the sense of feeling an obligation to return some favor. And as this opening observation demonstrates, the decision of whether to pay down debt is often as much one of emotion as it is cold financial math. Therefore, answering the question of whether I should pay down my mortgage early or try to invest the savings in the market requires looking at both the math and the emotion of debt. We’ll take each in turn.

The math:

The concept of “opportunity cost” is among the foundational concepts of Economics 101. Something’s cost is not just what I have to pay, but also what I’m giving up by not using that money to buy something else that I may get more value or enjoyment from. In this sense, the question of paying down debt is one of comparing opportunity cost: by choosing to pay down my debts faster, I’m foregoing the return I could have made by investing that extra payment in the market. If I can make a greater return on my investments than the interest rate on my debt, then I will come out ahead in the end, even if I end up paying more in interest. With historical returns on the S&P 500 (a basket of the 500 largest U.S. companies) equal to 9.7% on an annual basis, investing in the market should outperform any loan with an interest rate up to that same level.

BUT…We also know that investing can be risky, especially in the short run. My investments could go down or may not go up enough to keep up with the interest payments, which will be due every month come hell or high water! The risk that my investments won’t outperform the interest rate on my debt ultimately boils down to a question of time. Investments may go up and down in the short run, but in the long run we can expect the overall return to be less volatile.

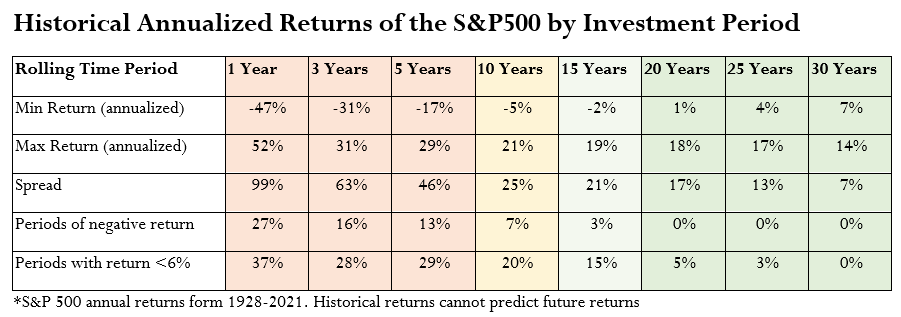

The table below shows the range of historical returns for the S&P500 since it’s inception in 1928 over various rolling annual time periods. It clearly shows that one-year returns can be quite volatile. In 1931, the S&P lost 47% of its value in a single year. In fact, from July 1931 to June 1932, the S&P lost 70% of its value! Doing just about anything else with your money would have been better! The odds of having a negative return in any year historically are approximately 27%. If we use 6% as a benchmark interest rate, there’s about a 37% chance you’ll be in the red in any given year by choosing to invest in the market instead of making an extra debt payment.

The longer the investment period, the lower the risk of experiencing losses

Now, if we look over longer investment periods, the picture improves dramatically. Looking at all 15 year periods, the worst your investments would have done is to have lost 2% per year, whereas on average they would have gained over 9% per year (enough to double your initial investment twice). Going even longer term, over every 30 year historical period your investments would grow, and not just grow, the worst you could have done would have been to earn 7% per year on average, which equates to a 785% return on your initial investment!

Of course, we must insert the obligatory disclaimer that past performance is no guarantee of future returns. The U.S. market may not perform in the next 100 years like it did the last, but hopefully this exercise gives you some perspective on the fundamental tradeoff between paying down debt and investing, and the key role that time plays in making the best decision. However, beyond this more objective analysis, we must also consider equally important subjective side of our complicated relationship with debt.

The emotion:

From an anthropological perspective, debts (both real or perceived) have bound social groups together and enabled expansion of the individual’s purchasing power beyond their present means. Our relationship with debt on an emotional/visceral level is rarely as cut and dried as a solely “rational approach” might suggest. We even categorize certain debts in moral terms like “good debt vs. bad debt” or “investment grade vs. junk,” and categorize borrowers themselves as “prime or sub-prime.” Some of us incur debt with too much ease, pushing out today’s expenses into the future, while others cannot sleep at night with debt hanging over them, no matter the terms. We may feel ashamed or embarrassed about debt, whether from personal experiences or cultural attitudes expressed in the media we consume or the families in which we were raised. We differ in terms of our ability to tolerate uncertainty as well as our ability to carry out a plan. For some, the forced savings associated with paying off a mortgage in 15 years instead of 30 years is a worthwhile tradeoff for someone who knows that they would probably spend the extra cash flow rather than save it.

Therefore, we must broaden the discussion beyond the binary pay off debt vs invest to include a holistic appreciation for the decisionmaker as fully human and make the discussion personal and remove judgment from the equation. What’s right for you may not be what’s right for your neighbor.

Questions to ask yourself and your family:

As you look at your debts, sort them by interest rate and remaining repayment period, then ask yourself the following questions:

How do I interpret my debt from a purely technical analysis?

How does my upbringing and life experience impact my relationship with debt?

Do you want your debts paid off by a certain age or by retirement?

What impact will my chosen repayment strategy have on my current and future cash flows?

Do I have the discipline to implement a savings/investment plan to be sure I achieve the benefits, or am I more likely to spend any savings?