Employee Stock Purchase Plans

For a broader overview of equity compensation: click here

How do ESPPs work?

Employee Stock Purchase Plans give participants the chance to buy company stock at a discount of up to 15% and are funded with paycheck withholdings. These plans are often designed to give you the added option to purchase the shares at the lower of either the starting price or ending price of the stock during the offering period, in addition to receiving the 15% discount. Not a bad deal! You’ll need to enroll in the plan ahead of time and elect a flat dollar amount or a percentage to be withheld from your paycheck. Tax law limits the maximum fair market value of stock that can be purchased using ESPPs to $25,000 and employers will typically limit the percentage of your salary that can be withheld for the ESPP to a maximum of 15%. Because of these limitations, ESPPs will not allow you to accumulate very large amounts of stock; however, through regular participation in the ESPP coupled with the immediate sale of those shares, you receive a virtually risk-free bonus.

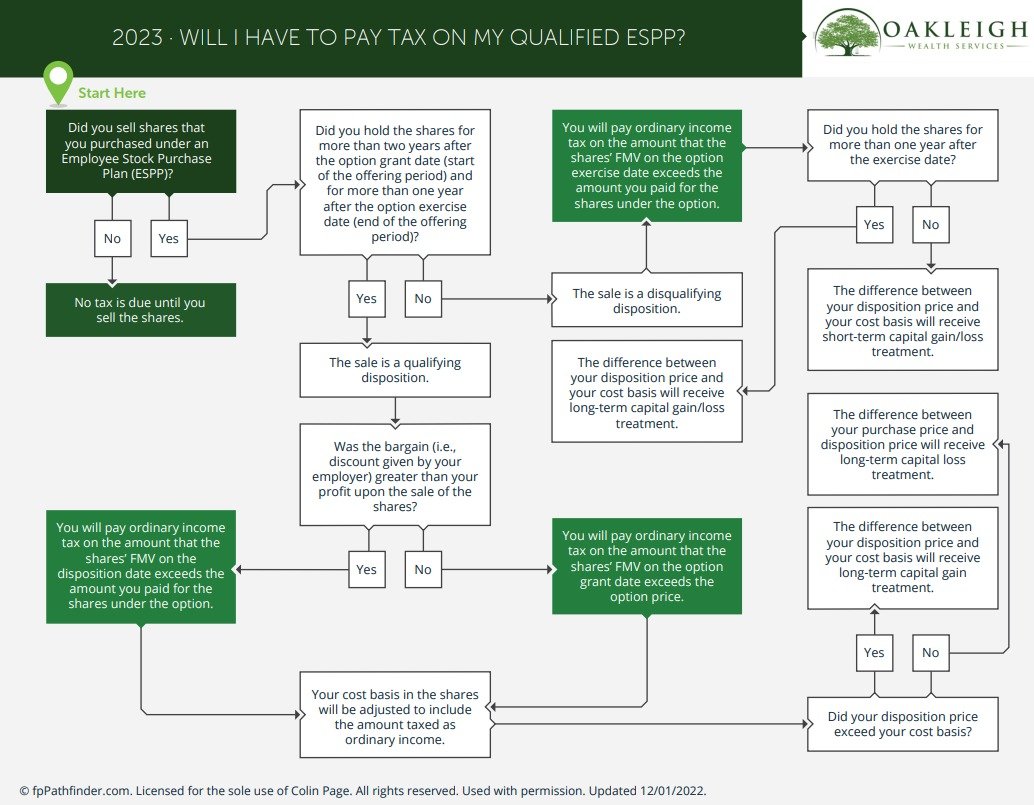

How are ESPPs taxed?

If your plan is a qualified ESPP, then the 15% discount at which you purchase the shares is only taxable when you sell the shares, at which point it will always be subject to ordinary income + employment tax (just like a cash bonus). The tax treatment of the bargain element (i.e. the difference between the market price of the shares and the exercise price on the day you purchase the shares) is more complicated. If you sell your shares immediately upon exercise, the discount and bargain element are taxed just like if you received a cash bonus, and you can use or invest that cash however you like. If you hold the ESPP shares longer (a minimum of one year from the exercise date and two years from the beginning of the offering period), you’ll be eligible for more favorable long-term capital gains rates on the bargain element (like ISOs). However, by continuing to hold the shares, you’re also exposing yourself to the risk of losses.

Should I sell my ESPP shares immediately?

The key question to ask yourself when deciding whether to hold the shares or sell them immediately is this: “If I got a cash bonus instead, would I use it to buy shares in my company?” If not, that’s a good indication that you should just cash out now, or as the Steve Miller Band put it, “Go ahead, take the money and run! Sure, you’re foregoing the opportunity to have some portion of the discount taxed more favorable capital gains rates (but that will take one to two years to realize). Unless there’s a very large gain, you may not want to let the tax tail wag the dog!

By selling immediately, it’s just like getting a cash bonus for the amount of the discount and having the money that was withheld from your paycheck returned to you. You can re-enroll to start the process all over again and collect your nearly risk free “bonus”. Rinse and repeat!

Pro-tip for ESPPs: Even if your employer does not report the discount or bargain element as income on your W-2, you are still required to report it as ordinary income on your tax return. Also, the custodian where you hold the shares may not correctly show any withholding amounts on your 1099 when you sell the shares. This often leads to double taxation if you’re working with an inexperienced tax preparer! Always request the supplement to Form 1099 (especially with E*trade accounts) and make sure you get credit for the withholdings that were already made.

If you’re wondering whether you’ll have to pay tax on your qualified ESPP, check out the flow chart below: