Articles by Oakleigh Wealth

The Backdoor Roth IRA

Roth IRA accounts are one of the most tax efficient retirement savings vehicles. But if your income is over the phase-out limits, you will not be able to contribute directly to your Roth IRA. Enter the so-called “backdoor Roth,” a loophole which allows you to add to your Roth IRA when your income is otherwise over the limit. BUT… it doesn’t come without risk.

Flow-Based Budgeting

Have you ever tried to make a budget, but never really bought into it? Maybe it went out the window when life happened. Perhaps you felt like the bad cop when trying to make sense of your credit card bill with your spouse. Or, were you were the one being interrogated?!

Budgeting is challenging. It can generate conflicts and induce guilt or shame. It can feel artificially constraining and time-consuming.

I’ve tried many budgeting systems, and I’ve quit them all. That is, until I learned about Flow-Based Budgeting.

Risk Tolerance & Risk Capacity

Determining the right investment strategy is crucial for achieving long-term financial goals. Two key factors that play a pivotal role in shaping an individual's investment approach are risk tolerance and risk capacity. While these terms are often used interchangeably, they carry distinct meanings, each influencing how investors should approach investment selection.

Rethinking Monte Carlo Simulations

Monte Carlo simulations are a common tool in the financial adviser’s toolkit. They can help us frame the likelihood of success of a given plan by applying a large number of statistical simulations of future market returns to your financial plan.

On paper, this approach to financial planning makes a lot of sense; however, applying Monte Carlo analysis as an ongoing real-world decision-making tool often results in misunderstanding, anxiety, and/or overconfidence.

Look beyond bonds for sustainable retirement income

With the recent increase in interest rates, retirees or those nearing retirement might find it tempting to invest their nest eggs in longer-dated government bonds to secure a stable, long-term income. After enduring the "Great Financial Crisis," it's understandable why exiting the stock market might seem appealing. When you have only a few working years left or have already retired, the prospect of another market downturn can be quite daunting.

However, following this line of thinking could lead you into trouble!

10 Free & Effective Ways to Protect Yourself from Identity Theft

The threat of identity theft looms larger than ever before. Cybercriminals are constantly finding new ways to steal personal information and wreak havoc on your financial well-being. Protecting yourself from identity theft is an essential piece of a comprehensive financial plan. Here are ten inexpensive and effective things you should be doing to safeguard your identity:

Can I make a “Mega Backdoor Roth” Contribution?

Say you have maxed out your pre-tax IRA and 401(k) contributions (or Roth IRA and Roth 401(k), if current tax rates are lower) and you still have the ability to save more, you don't need liquidity and want to do it as tax efficiently as possible.

In certain cases, you may be eligible to make a Mega Backdoor Roth contribution and contribute tens of thousands more to your Roth IRA, regardless of your income level.

Q: How much liability insurance do I need? A: As much as you can get!

Cut to the chase: with liability insurance, you should carry as much as you can. Most individuals and families carry liability insurance from two main sources: their home and auto insurance policies. But this may not be enough to fully protect your assets in case of an accident or a lawsuit.

That’s where “umbrella” insurance comes in, to cover you above the liability limits of your home and auto policies. However, you must coordinate coverage with your home and auto policies to make sure that you don’t have a potentially expensive gap in coverage.

You need a will, but do you need a lawyer?

Estate planning can be an uncomfortable subject. Most of us would prefer not to think about our demise, so we avoid it. Or, you may not know where to start, and the added hurdle of finding a lawyer has led you to put off creating or updating your will. But, like most people, you probably don’t need a layer to make a will.

June 2023 Newsletter: Tax Planning

This month's newsletter is all about taxes!

You're already ahead of the pack if you’ve kept reading beyond the first line. So many individuals try to limit the time and brain space devoted to taxes to the scramble of weeks leading up to Tax Day. The saying about “death and taxes” notwithstanding, there actually is something to be done when it comes to managing the impact and timing of your tax liability over the long run. Still, the time to do something about it is not the first two weeks of April when the bill comes due.

Defining the Elements

At Oakleigh, we use an app called Elements to show a quick snapshot of your financial health and track specific key metrics over time. This is very similar to how a doctor might track your vital signs to understand your physical health and quickly diagnose specific issues. Of course, there’s a story behind all of these numbers and we would dive much deeper for a full financial planning engagement. However, you might be surprised by how many important issues can be uncovered and addressed from these high-level metrics alone.

To Roth or Not to Roth? Deciding Between Roth and Tax-Deferred Savings

The decision of whether to contribute to a Roth or a traditional retirement account basically boils down to timing: do I pay taxes now or later? While both types of retirement accounts are powerful tools for building wealth, this seemingly simple binary can produce some unique planning opportunities with meaningful tax savings for many individuals.

Donor Advised Funds: Don’t be daft, use a DAF

Donor Advised Funds(DAFs) are a simple but powerful tool to facilitate charitable donations, manage tax liabilities, and create a culture or legacy of charitable giving. No one donates to charity just to save on their taxes (the math doesn’t work like that!), and the many personal benefits of charitable giving are not necessarily correlated with the size of your gift or the resultant tax deduction. However, if you are already inclined to give (and I recommend it), DAFs are one of the more effective arrows in the quiver of a financial planner.

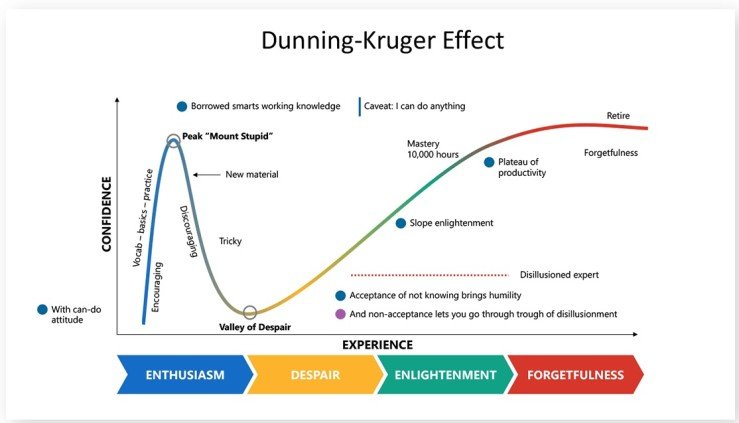

The Dunning-Kruger Effect (in investing (and life)

Dunning & Kruger’s study demonstrated something we all know to be true from experience: people with low levels of knowledge, skill, or competence tend to overestimate their own abilities. Their findings have broad implications for personal finance and investing, but it also raises broader questions about the human experience more generally. We are all prone to over confidence. Mastery, in any arena of life, requires that we overcome the despair of failure through dilligence and humility. But is that all there is?

8 Things You Should Spend Your Money On

Most of us don’t need any more help perpetuating our arrival fallacies or justifying impulse purchases. Ad agencies, search engines, and Instagram algorithms already have us figured out. Ask my wife, I have no trouble justifying any number of purchases based on how much time they’ll save, what a great investment they are, or how much better off our lives will be once we have ______.

Then there are others whose struggles are in the opposite direction. We all know friends and family members who have plenty of money, but have difficulty spending it, even on things that would really improve their lives, ease some burden, or add a modicum of comfort or enjoyment. “Penny wise, but pound foolish,” as they say..

Whichever camp you fall into, this list of “8 Things You Should Spend your Money On” is for you.

How much should I be saving? Am I on track?

Your savings rate tells an important story about your current financial wellness and preparation for long term financial security. Setting a reasonable savings goal and sticking with it is highly correlated with financial independence. In this article, we'll answer following questions: How much should I be saving? Am I on track? How can I increase my savings rate?

Making Work Optional

This seemingly complicated question can be boiled down to a simple, but powerful metric: your Total term score.

This single number estimates the number of years a person could live on his or her current assets if they did not grow. This includes your cash, investments, business value, and real estate equity. While this key metric is not terribly difficult to calculate, it is powerful in its simplicity and its nuances can lead to very interesting discussions.

A Transparent Look at “Fee-Only” Financial Advising

There are so many different types of “financial advisors” in the marketplace, there’s no wonder that many folks lump them all together into one. Tell someone you’re a financial advisor at a party and they’ll either ask you for your latest stock tip, or they’ll quietly shift their wallet to their front pocket so they can keep an eye on it! In my experience, sadly, the latter is probably the more rational response!