Making Work Optional

How much wealth do you need to make work optional?

Firstly, notice the subtle difference between the question above and the question, "How much money do I need to retire?"

Many individuals with enough funds to retire choose to continue working, while others yearn for the freedom to step away. Our feelings about work can fluctuate based on circumstances, attitudes, and unexpected events. Even if you’re someone who cannot envision ever retiring, your [spouse, boss, business partner, body, health, or grandchildren] may have other plans for you!

Before trying to answer the titular question, ask yourself, “What would I be doing if work was optional?” What if you could pursue more meaningful work, even if it’s lower paying? What would that freedom mean to you?

As a financial advisor, my primary goal is to guide clients toward growing their assets to make work optional sooner. However, your answers to deeper questions about life priorities should steer our collaborative efforts. Even if retirement seems far off, how can you incorporate more of the activities you value into your life now?

The Total Term Score

From a financial perspective, the question “How much wealth do I need?” can be boiled down to a simple yet powerful metric: your Total term score (Tt Score). This single number estimates the years you could sustain your current lifestyle based on your existing assets (excluding debts).

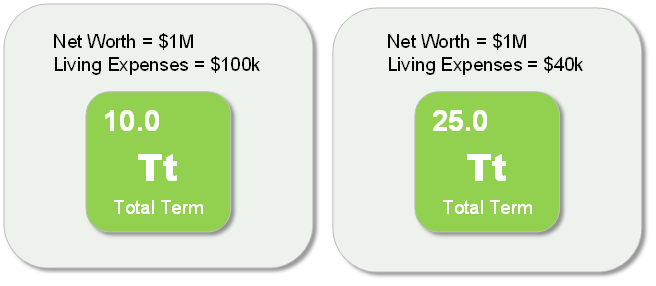

For instance, someone with $1M in assets spending $100k annually would have a Tt score of 10.

Would you be comfortable if you stopped making income, knowing that you could afford to live your current lifestyle for 10 years?

Most people would say no.

What if you had $2M in assets and a Tt score of 20, would you be comfortable without earning an income then?

Perhaps if I’m 75 years old, but not if I’m 55 years old. Two people can have the same Tt score, yet be in very different situations.

Likewise, two people can have the same net worth and have very different outlooks depending on their spending habits.

Factors Influencing Tt Score

There are only two ways to increase your Tt score: grow your assets or decrease your spending. Most folks would rather focus on the former by saving and investing, rather than cutting expenses. While the simplicity of the Tt score is beautiful, there are important nuances to consider when setting your Tt goal.

People with the same Tt score can be in very different situations due to their goals, age, risk tolerance, and other income sources. Expectations for investment returns and inflation play a vital role also.

Investment Returns and Inflation

We expect your assets to grow over time unless you hold your net worth in cash. We also must account for inflation, eroding the purchasing power of your money over time. So what return would you need to be sure that you never run out of money while maintaining your current lifestyle?

Say you’ve got a Tt score of 10, (e.g. $1M in investments and $100k in annual expenses). You’d need to earn a 10% return above the rate of inflation every year to sustain your annual spending without eating into your nest egg.

A 10% return on top of inflation, year after year, is too aggressive. While it’s certainly possible to achieve investment returns above 10% at times, what happens if your investments go down? Returns can be volatile, so you’ll eat into your nest egg and need to cut expenses or go back to work.

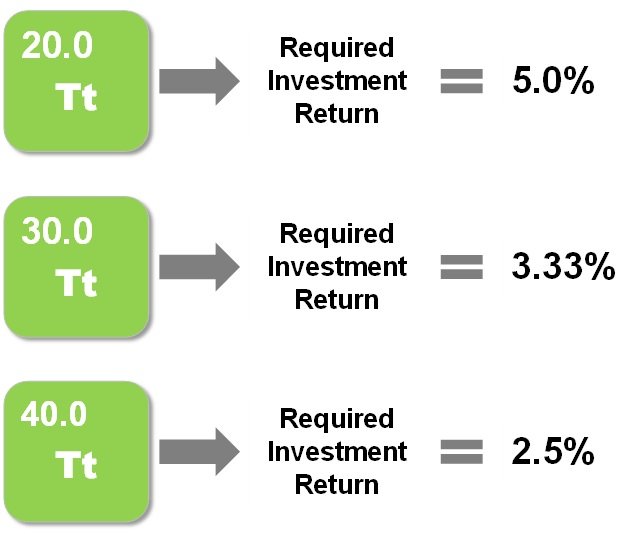

What if you have a Tt score of 20 (e.g. net worth of $2M and annual spending of $100k)? What rate of return would you need to earn?

You’ll need a return of 5% above the rate of inflation. (i.e. $2M * 5% = $100k). This feels a lot more realistic, but to get returns over 5% over inflation, you’ll need to take more investment risk, which makes you vulnerable to declines, which could be particularly detrimental to the success of your plan if they’re experienced early (say a recession hits two years after you stop working, and all of a sudden, your investments are down 15%).

Now consider a Tt score of 30, you just need to earn 3.3% above inflation, which is much more doable! At a Tt score of 30, you can feel very confident that you can stop working now, no matter how old you are. Even with very conservative investments, you’ll likely not need to cut very deeply into your savings, let alone run out of money completely at your current spending rate.

If you have a Tt score of 40, you only need a real return of 2.5%, which likely means that your assets will continue to grow meaningfully if you maintain your current spending levels.

Setting a Total Term Score Goal

This is a personal question, and you want to make sure that you have a good understanding of your actual living expenses, some idea of what they will look like going forward, and whether you are willing to be flexible (i.e. adjust your spending if needed).

To retire young, most folks will aim for a Tt score of 25-30x, which would allow you to withdraw your annual expenses from your net worth indefinitely with investment returns of 4%-3.3%. But this is a general guideline, not an absolute rule. Your required Tt score may be higher or lower depending on your age, other sources of income (e.g. social security or pension), the types of assets you have, how you are invested, and how flexible you are to spending adjustments. You may be in good shape with a much lower Tt score once these other factors are weighed.

Tt score may be the single most descriptive metric I look at as a financial adviser because it captures so much information in a single number. However, delving into the nuances is especially if you're on the border or if your assets are illiquid.

Bottom line:

Before delving into these complexities, focus on the broader questions guiding your financial decisions:

What do you value most? What gives you a feeling of purpose or joy?

What would you be doing if work was optional now?

What would that freedom mean to you and your family?

Answer these questions first. Thomas Merton articulated it best:

“People may spend their whole lives climbing the ladder of success only to find, once they reach the top, that the ladder is leaning against the wrong wall.”

Would you like to calculate your own net worth and Tt score?

At Oakleigh, we use a tool called Elements, an easy-to-use mobile app that helps you measure and monitor how financially healthy you are. Just like a physician measures your vital signs, we use the Elements scorecard to gauge how well you’re doing in each area of your financial life. From there we can help you decide where to focus your efforts and how to better align your time, money, and energy with what really matters to you.

Get started with our easy-to-use mobile app to create your own scorecard in 5-10 minutes. We’ll follow up with a free assessment by email.