Financial Assessment for a Couple In their Mid-30s

Meet Mike & mary and their two young children!

What Does a Financial Assessment Look Like?

At Oakleigh, we use an app called Elements to show a quick snapshot of your financial health and track specific key metrics over time. This is very similar to how a doctor might track your vital signs to understand your physical health and quickly diagnose particular issues. Of course, there’s a story behind all of these numbers and we would dive much deeper for a full financial planning engagement. However, you might be surprised by how many important issues can be uncovered and addressed from these high-level metrics alone.

Here’s an example assessment of a married couple in their mid-30s with two young children. Mike is an architect working for a larger firm making $95k per year and his wife, Mary, just received a raise at the consulting firm she works for, and is now making $260k per year after finishing an executive MBA program. They have two children in daycare and they feel like they should be able to do more with the good money they’re making now, but life just continues to get more complicated.

Here is their personal financial statement (a.k.a. balance sheet) and their scorecard that they created in our app in just 15 minutes:

Mike & Mary’s Financial Statement

Mike and Mary’s Personal Financial Statement (Created in Elements)

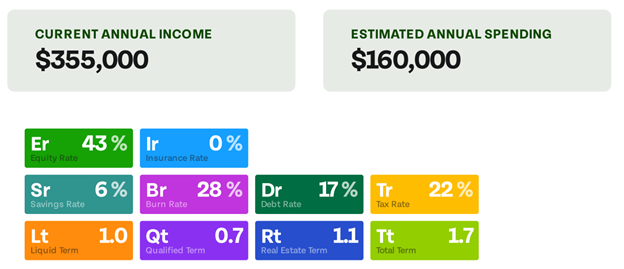

Mike & Mary’s Elements Scorecard:

Elements Scorecard (created in the app)

Note: This information is based on real people whose names and some identifying details have been changed.

Mike & Mary’s Financial Assessment

Mike and Mary, thanks for taking the time to upload your information to Elements for your free assessment.

I always start with the Total Term (Tt) score in the bottom right corner of the Elements scorecard. Total term equals your net worth (i.e. total assets minus debts) divided by your annual spending. Your net worth is $272k and you estimated your family’s annual spending to be about $160k. Therefore, your Total Term score of 1.7 means that you could live for about two years off your net worth if you stopped earning money today.

Of all the elements, Total Term is key to answering questions about retirement readiness, making work optional, and building financial flexibility. To truly make work optional, most folk will need a Tt score of 25-30, depending on their age. While you have a long way to go (no surprise there given your age and career stage), building your Tt score through savings and long-term investments will be a key focus of any financial plan for you. For more information about this powerful metric, see Making Work Optional — Oakleigh Wealth Services

Strengths:

Income: Congratulations on your recent raise! I love to catch folks after they’ve received a meaningful jump in their income and before their expenses have risen to soak it all up. This will give you a lot of flexibility to implement a plan without needing to make difficult changes to your current lifestyle. You’ve done a great job keeping your expenses in check over time and not taking on too much debt.

Debt Rate (Dr): you’re currently spending 17% of your income on debt service. Generally, I recommend keeping mortgage payments under a maximum of 25% of income and total debt expenditures below 30-35%, though lower is always better. Your score is excellent. Nice job refinancing your mortgage when rates were at historic lows. Public Service Loan Forgiveness is likely not a possibility for you, but the student loan debt you have is very manageable with your current income. At this point, building your total term score and net worth through saving and investing is probably more important than paying off debt. See Invest or pay off debt? — Oakleigh Wealth Services

Weaknesses/Opportunities:

Savings Rate (Sr): At only a 6% savings rate you’re not going to be on track for a traditional retirement (i.e. work until age 65 then stop completely) without a big step down in expenses or outside help. You should probably target a savings rate closer to 15% (including any employer matches). If making work optional before 65 is a goal of yours, you may need an even higher savings rate. See How much should I be saving? Am I on track? — Oakleigh Wealth Services

Qualified Term (Qt): I see you both have 401ks and Roth IRAs set up. As you grow your savings rate, you’ll want to take advantage of both Roth and pre-tax accounts to build wealth in a tax-efficient manner, which can add up to a significant impact on your after-tax wealth over the long run. See Optimizing Traditional vs. Roth Retirement Savings — Oakleigh Wealth Services

Equity Rate: (Er): This represents the percentage of your investable assets in stocks vs. bonds or cash. Your equity rate is a simple measure of how much investment risk you’re taking, assuming your holdings are well diversified (i.e. not concentrated in single stocks). Historically stocks have offered the highest long-run returns, but they also have considerably higher volatility or potential for losses in the short run if the markets or economy falter. Your Er of 43% is quite low for someone who has such a long-term investment horizon. While an appropriate Er depends on your ability to tolerate the risk and other goals, an equity rate of 80%-100% is generally appropriate for someone in their 30s who is saving for retirement.

Questions:

Liquid Term (Lt): I noticed that you have over $100k in cash in a savings account. Is there a reason you have so much cash? If we were to work together, we would dig into how much cash you should have on hand for an emergency, and then invest the rest.

Insurance Rate (Ir): Do you have any life or long-term disability insurance policies? I see you didn’t add any policies to Elements. Most people don’t think much about insurance until they have kids, but it is critical to make sure your family is covered if you’re no longer in the picture, or if you cannot work for a long period. Many people have some coverage through their employer, but these policies are usually not enough (and not always the most cost-effective or tax efficient).

Burn Rate (Br): Your estimated annual spending number seems low at 28%. Most folks in your income range spend between 40-60% per year, not including debt payments. Have you ever tracked your spending? Your Savings Rate, Burn Rate, Debt Rate, and Tax Rate should add up to 100% since these are the only buckets in which your income can possibly end up. But, based on the data you uploaded, I see we’re only accounting for 73% of your income. This means there could be an opportunity here to allocate the difference toward increased savings and something more fun (e.g. family vacation, house project...). We may also be missing something.

That’s it! Feel free to reach out if you have any questions or to schedule a consultation if you’re interested in pursuing a holistic financial planning engagement.

Create your own Scorecard and get a free assessment!

Click the button below for an invitation to download Elements and create your own scorecard and financial statement. I’ll follow up by email with a free assessment like the one above.