I-Bonds ain’t what they used to be

Did you buy I-bonds in 2022 when they paid some of their highest-ever interest rates? That bond you bought in May of 2022 with a 9.62% annualized interest rate is now paying only 3.94% and this will be cut again on May 1st. For comparison, current money market rates are north of 5% and one-year treasuries are paying 5.16%.

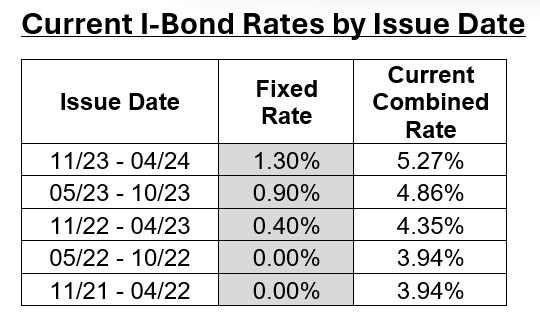

Perhaps you’ve seen that a newly issued I Bond today is paying 5.27%. Not bad! But you're not getting that rate if you bought bonds before October 2023. That’s because I-bonds are issued with both a fixed interest rate component and an inflation rate. The inflation rate changes every six months in May and October based on the Consumer Price Index (CPI) levels, but the fixed rate doesn’t change for the bond's life.

I-bonds issued between May 2020 and October 2022 carry a 0.0% fixed rate, whereas the most recently issued I-bonds have a 1.3% fixed rate.

Should I redeem my I-bonds?

Here are a few factors to consider:

What is the purpose of this investment and your time horizon? I-Bonds were an attractive short-term investment back in 2021 and 2022. But are they a great long-term investment? Historically, no. If your objective is long-term growth that meaningfully outpaces inflation, you should probably invest in a diversified portfolio of mostly stocks. If you’re just looking for a short-term place to stache cash, you may want to consider other more liquid and higher-yielding options like money market funds, treasuries, and CDs. Check out our article for more info on the role of bonds in a retirement portfolio: Look Beyond Bonds for Sustainable Retirement Income — Oakleigh Wealth Services

There are modest early redemption penalties if you held your bonds for less than 5 years: You can cash in (redeem) your I-bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example, if you cash in the bond after 18 months, you get the first 15 months of interest. Say you’re currently getting 3.94%, that’s a loss of roughly 1% of interest if you redeem early. How long it will take to make that back depends on how you invest the proceeds. If you invest the proceeds in a money market earning roughly 5% it will take you a year to break even.

Don’t forget about the taxes you’ll owe, because the IRS won’t! Typically, investors choose to wait to report the earnings from I-Bonds until the year when they get their money back, at which point it becomes taxable income at your marginal income bracket. However, if you use the money for qualified higher education expenses, you may not have to pay tax on the earnings (see Using bonds for higher education — TreasuryDirect). If you do choose to redeem, be sure you download the 1099 from Treasury Direct next January. Treasury Direct does not mail 1099s, and it’s easy to forget this when you file taxes next year. You can be sure that the IRS will not forget! Expect to receive a letter if you forget to include the income.

Interest rates will reset (lower) May 1: The new inflation rate in May will likely decline meaningfully, perhaps by 1%. It’s unclear what the new fixed rate will be (up, down, or sideways). If rates decline as expected, it may be worth waiting until after May 1 to cash out. If you are concerned about a near-term spike in inflation, I-bonds are a fine place to put some cash. But since you’re limited to only $10k of purchases each year, this decision is unlikely to make a meaningful difference, and I don’t believe in trying to “time inflation” any more than trying to time the stock market.

For more information about how to redeem your I-bonds see: Cash EE or I savings bonds — TreasuryDirect